The price of housing can take up a big quantity of anybody’s finances. The overall rule of thumb is to maintain housing prices round 30%. However what about the price of filling your house with the objects you want?

Apart from the price of your housing cost, it’s may also be costly to fill your house with furnishings, home equipment and different issues that you could be want or need for consolation.

We’ve lately been out there for a brand new sofa and a chrome steel range. Each some fairly costly purchases. These weren’t actually emergency objects. So, I felt no must dig into the emergency fund and tried to money stream them as an alternative.

The thought of quoting costs from our native Hire a Heart did sound like an possibility as effectively. Everyone knows I’m not a fan of financing furnishings, however I knew Hire a Heart has a ‘6 months identical as money’ program. BIG mistake.

After doing a little analysis on this firm and its affords, I noticed Hire a Heart was doing a little severe scamming and extra individuals wanted to grasp how this place operates. On this submit, I’m going to elucidate why Hire a Heart is a rip off to the typical particular person.

Pay as You Go?

What attracts individuals most about Hire a Heart is the choice to buy that big-ticket merchandise like a furnishings set or an equipment with out actually paying for it in full.

Can’t afford a brand new sofa? Come to Hire a Heart and get on a plan so you’ll be able to take it residence at present with little cash down and pay as you go to settle your steadiness.

Hire a Heart sells all the pieces from TVs, front room furnishings, and bed room units to kitchen home equipment, computer systems and smartphones. They carry massive manufacturers and don’t have credit score examine necessities for his or her cost plans.

This implies, so long as you’ve gotten an revenue and make a down cost, you’ll be able to probably get on a plan to pay your merchandise off in weekly, bi-weekly and month-to-month funds. After all, you’ll pay extra general in the event you use their long-term cost plans since you’ll get charged curiosity.

Nonetheless, Hire a Heart has a 6-month ‘identical as money’ program. This program ensures that you simply gained’t pay further as long as you repay your buy in 6 months. Should you’re wanting to save cash on curiosity, this 6 months identical as money possibility might sound promising, however don’t fall for it!

You’re Not Constructing Credit score

After I financed my first sofa again in faculty (one thing I’d by no means ever do once more BTW), I did it underneath Ashley Furnishings’s credit score constructing program. This implies my funds had been reported to all three credit score bureaus. Paying off the sofa helped me construct some constructive credit score historical past.

Hire a Heart doesn’t examine credit score if you apply. This implies they haven’t any intention of reporting your cost to the credit score bureaus – they usually don’t. Nonetheless, you’re getting charged curiosity and a basic up-charge in your purchases anyway. There are a lot better methods to construct your credit score other than financing furnishings, however I’m simply making an attempt to make a degree.

Associated: I Raised My Credit score Rating By 150 Factors, Right here’s How

Your funds are merely lining the pockets of Hire a Heart. In the meantime you’re caught making overpriced weekly and month-to-month funds. The objects Hire a Heart sells don’t respect in worth so it makes extra sense to only purchase them in money by yourself.

Overpriced…Every little thing

I discussed earlier how I did some shopping on their website as I used to be contemplating the 6-month identical as money provide. I regarded up a range together with some furnishings since I used to be additionally in the hunt for a leather-based sofa. Having a canine actually summed up why we have to change to leather-based furnishings to any extent further.

I used to be actually shocked to see Hire a Heart’s costs for a single piece of furnishings. Then it hit me. The costs are severely marked up no matter how quickly you pay the merchandise off.

If anybody would do a fast Google search to check costs, they’d see that Hire a Heart is overcharging prospects. Certain, they carry good manufacturers however you’ll be able to actually discover a higher deal by going straight to that model and shopping for the furnishings or equipment you want.

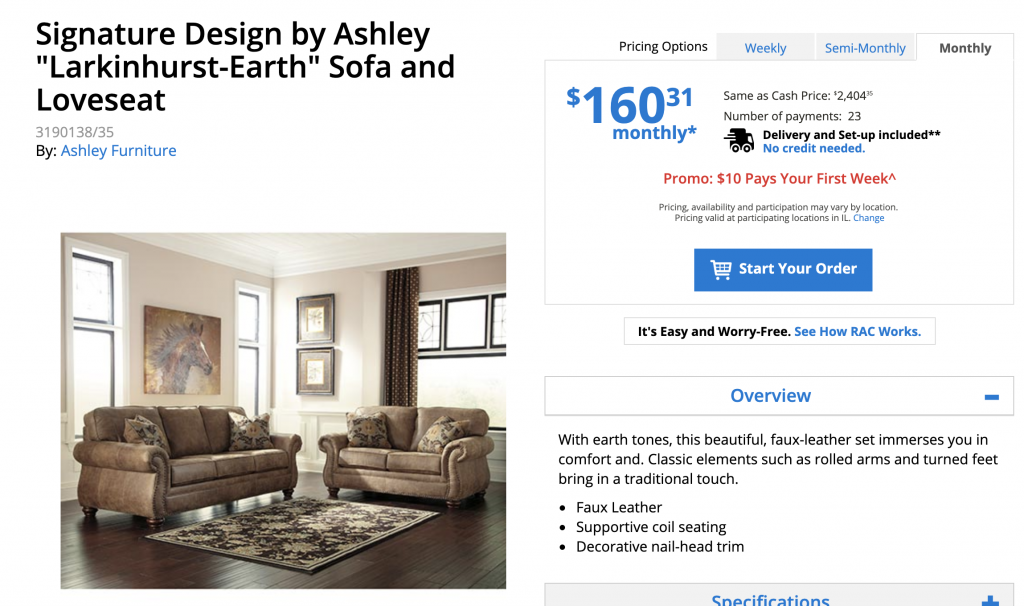

As you’ll be able to see, this couch and loveseat set is $160.31 per thirty days at Hire a Heart. You’re required to make funds for nearly 2 years….in different phrases, $3,687.13!!!

Should you resolve to pay the set off in 6 months, you’d nonetheless pay $2,404.35. Ouch.

You could discover it fascinating that Amazon is promoting the very same loveseat for $476 and the couch for $509. Should you keep away from these marked-up costs, you might rating this set for underneath $1,000.

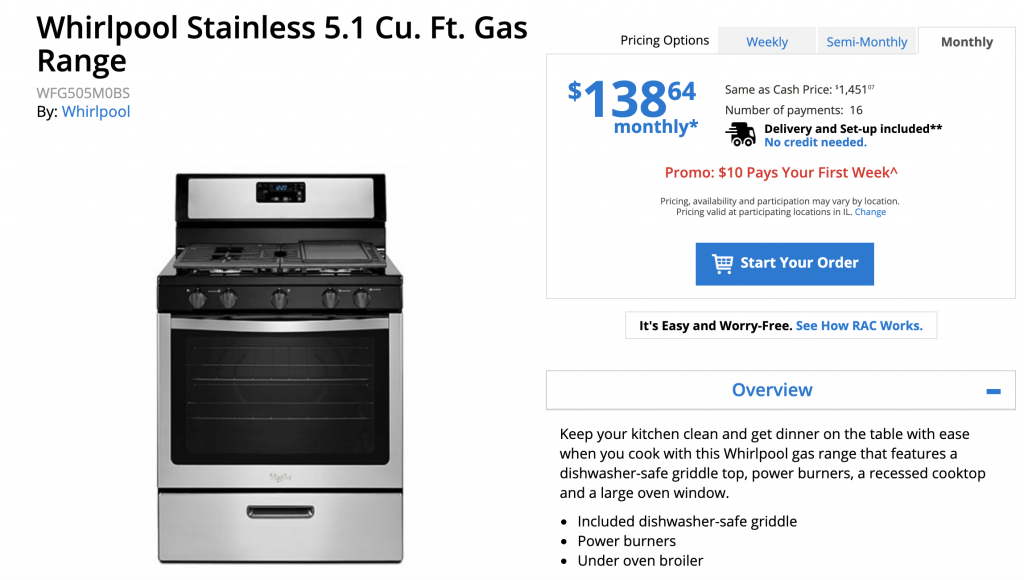

This Whirlpool 5-burner gasoline vary range is $138.64 per thirty days at Hire a Heart. It takes 16 months of funds to personal it and also you’d find yourself spending $2,218.24. The 6-month ‘identical as money’ worth is $1,596.46.

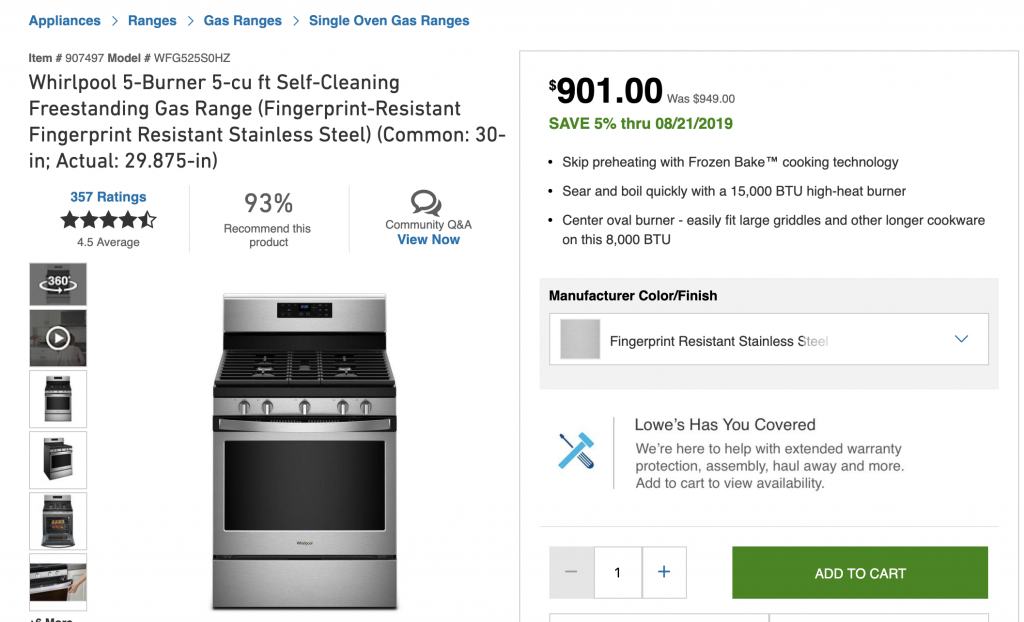

An analogous chrome steel gasoline oven from Lowes prices round $900. Different manufacturers like Normal Electrical solely price round $600 to $700 relying on the kind.

Sketchy Contract Phrases

Hire a Heart’s contract is a legally binding settlement stating the phrases of the transaction together with funds, taxes, charges, the variety of funds, price to amass possession, late charges, and extra. If prospects don’t observe the phrases of the settlement, they might get their objects revoked.

After making all these overpriced funds, think about falling on arduous instances and getting your furnishings repossessed so that you now don’t have anything to point out for it.

One of the vital fascinating issues about Hire a Heart’s contract is the way it states that you don’t construct any fairness towards the merchandise because it stays the property of Hire a Heart till you pay the agreed quantity to personal it. This firm’s contracts are tremendous sketchy. Many individuals have shared that they actually didn’t perceive the character of the phrases and the way a lot the charges had been initially concerned.

There are 1000’s of individuals who’ve complained about being trapped in a contract with Hire a Heart and acquired scammed out of a ton of cash. It sucks to listen to about how some individuals have been harassed over the telephone and in particular person by cost collectors. Nerd Pockets revealed an article to lend some tricks to annoyed prospects longing to get out of their Hire a Heart contracts.

In it, they recommended that you simply keep away from the largest markup and added charges by paying off your merchandise inside 90 days of the lease settlement. Should you actually need out of the contract, it’s possible you’ll must return your stuff altogether.

Charges on High of Charges

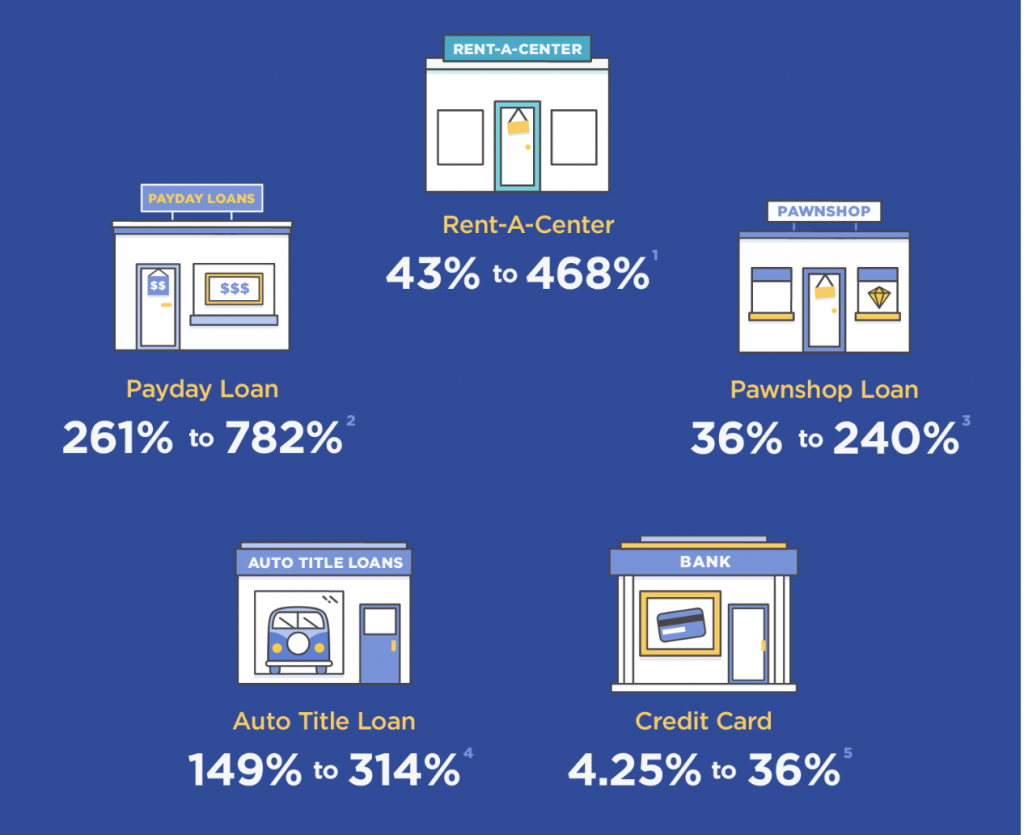

I searched excessive and low for a breakdown of Hire a Heart’s charges however that info appears locked and sealed for some cause. Fortunately, Nerd Pockets accomplished an in-depth examine in 2017 about their charges and outrageous rates of interest.

Their APR charges could be corresponding to payday loans and within the triple digits on common.

Supply – Nerd Pockets

The corporate additionally affords choices charges that may add on to what you’d must pay.

Their loss-damage wavier could be as much as 10% of the entire price of the lease in some states. Should you enroll in RAC Advantages Plus, this may offer you some coupons and reductions. Nonetheless, it’s possible you’ll not use them and it provides round $13 per thirty days to your lease settlement.

Don’t overlook about state and native taxes. It’s no secret that you’ll have to pay them for lease the merchandise however Hire a Heart prospects additionally pay extra for the additional ‘companies’ as effectively.

The Bother With Instantaneous Gratification

Reality be informed, shops like Hire a Heart and their different counterparts wouldn’t exist if individuals weren’t so tempted to present in to instantaneous gratification. This firm seeks to learn from the truth that our society is praising unhealthy comfort components and quick transactions.

Why wait to pay for furnishings in money when you might put $10 down and get every week freed from funds – solely to be caught overpaying to your merchandise by 1000’s of {dollars} over the subsequent 12 months or two…

While you take a look at it this manner, the maths definitely doesn’t add up. We paid about $460 for our leather-based sofa in money which was less expensive than what Hire a Heart was charging.

We paid $644 for our new chrome steel gasoline vary oven when Hire a Heart would cost us $1,400+ for one thing related. The primary distinction? You need to be prepared to be affected person, weigh different choices, and apply delayed gratification.

My husband and I waited to get a brand new oven and used an electrical skillet (that was a marriage present) to cook dinner our meals for just a few weeks. Within the meantime, we each hustled arduous to give you half of the fee. He drove some further hours for Uber and I picked up extra consumer work. We each got here to the desk with $322 every to place down to purchase the oven in money.

Delaying your gratification can prevent a lot cash in the long term and in addition permit you to actually respect and cherish the issues you’ve gotten. I’m grateful for that indisputable fact that nobody can come knock on my door and take my furnishings or home equipment away as a result of I personal them outright.

Associated: 80+ Additional Earnings Concepts That Don’t Suck

20 Methods to Make Additional Cash Immediately

Aspect Hustles Explored: How you can Get Began With Freelance Writing

5 Causes Why You Ought to Begin Driving for Uber

Some Options to Leasing Furnishings and Different Stuff

Though it’s clear that Hire a Heart is a rip-off, they’re not the one retailer scamming individuals out of their hard-earned money. Different related furnishings leasing shops are mainly doing the identical factor.

So what’s an alternate if you wish to purchase some furnishings, costly electronics, or massive home goods?

Be Affected person

That is our high possibility. Once we purchased our home, after all I needed to furnish and adorn it. I additionally didn’t need to finance a bunch of stuff and be buried in month-to-month funds. So I waited.

We purchased one small sectional virtually new off the Fb Market and I used my outdated sofa (from our residence) for our household room. Slowly, we saved up cash and got here throughout offers so as to add furnishings and different decor to our residence. Certain, it wasn’t the quickest answer, however I’m glad that I personal all the pieces in my residence and don’t must be slowed down by all of the funds.

Vacation Gross sales

We really purchased our range for a steal because of a 4th of July sale. Whether or not you’re trying to purchase furnishings or family home equipment, you’ll be able to depend on vacation gross sales that will help you save anyplace from $100 – $200 on the merchandise.

I took benefit of a web based Black Friday deal at Finest Purchase to get my Macbook Professional for a number of hundred {dollars} lower than it was usually listed for.

Store On-line

There are tons of low cost websites you need to use to purchase your furnishings and different objects for much less. I like websites likes Wayfair, Brad’s Offers, and Overstock could be nice locations to attain offers on high quality furnishings.

Don’t overlook to make use of Rakuten (Ebates) when purchasing on-line to earn money again.

You may also bid for objects on eBay and see what Amazon has to supply.

Associated: Rakuten (Ebates ) Overview: Earn Cashback For On a regular basis Procuring

Store Used

The small sectional I purchased after we first moved into our home was gently used and from the Fb market. I additionally acquired our kitchen desk from {the marketplace} as effectively and saved tons of of {dollars} on each purchases mixed.

Our glass desk sits 6 and the chairs had been lately upholstered so it regarded similar to new. You may try resale retailers and different websites for gently used choices if it helps you keep away from getting scammed by Hire a Heart.

Associated: How you can Begin Saving Cash on Furnishings (New and Used)

0% APR Credit score Card

I current this selection with warning as a result of I’m not likely a fan of individuals racking up debt on a bank card, even when there’s no curiosity. Nonetheless, if you have to make an pressing buy, it is a a lot better possibility than doing rent-to-own with Hire a Heart.

You’ll want good credit score within the first place to qualify for a 0% curiosity bank card however that is how I paid for my Macbook Professional. I actually wanted a dependable pc for my enterprise – it couldn’t wait as a result of how else would I have the ability to generate income since that is my full-time job?

These laptops are so costly and even with the sale worth, I didn’t need to drain my financial savings so I used Finest Purchase’s 0% APR possibility. So I put $200 down and paid $100 per thirty days till the top of the 12 months.

With this selection, the bottom line is to keep away from going overboard with the acquisition worth of the merchandise to make sure you can really pay it off in the course of the o% APR promotional interval. Keep away from making different purchases on the cardboard when you’re paying again the steadiness to make it simpler.

Associated: 6 Wholesome Habits That Lead To a Higher Credit score Rating

Abstract – Is Hire a Heart a Rip Off?

I hope this didn’t come off as an ‘I hate Hire a Heart’ article, however I simply actually don’t like after I see corporations reap the benefits of different people who find themselves on the lookout for an answer that gives some monetary reduction.

A rip-off is outlined as a dishonest scheme. A rip off is outlined as dishonest somebody out of cash financially. I imagine Hire-a-Heart is doing each.

Simply because individuals signal an settlement doesn’t imply they absolutely perceive the phrases and might’t see previous the advertising and claims to “purchase now and pay $10 every week later”. Hire-a-Heart ought to do a greater job at explaining their contract as a result of from the appears of all their complaints on-line, individuals didn’t absolutely perceive or help the phrases of the settlement.

The reality is, in the event you can’t afford to purchase furnishings, family home equipment and different objects, you shouldn’t even contemplate going to a retailer like Hire a Heart within the first place. They prey on individuals who want sure objects however can’t afford them. They entice prospects with the thought of versatile, low-cost funds however this finally ends up locking you right into a long-term contract with ridiculous charges and curiosity.

As a substitute, play the ready sport and actually ask your self if you have to buy the merchandise at the moment. Can you set it off and save up as an alternative or watch for a superb deal? In that case, you in all probability gained’t remorse it ready just a few weeks or perhaps a few months to probably save over a thousand {dollars}.

What are your ideas on leasing furnishings?

After I acquired my first residence in faculty and checked out my empty front room, I felt dangerous. I caved and financed furnishings however wanting again, I wasn’t going to die or be scarred for all times had I went just a few months with out that stuff and saved up. Have you ever ever executed enterprise with Hire a Heart or an identical retailer?

Cease Worrying About Cash and Regain Management

Be a part of 5,000+ others to get entry to free printables that will help you handle your month-to-month payments, cut back bills, repay debt, and extra. Obtain simply two emails per thirty days with unique content material that will help you in your journey.