CPI figures regulate expectations

CPI information indicators warning

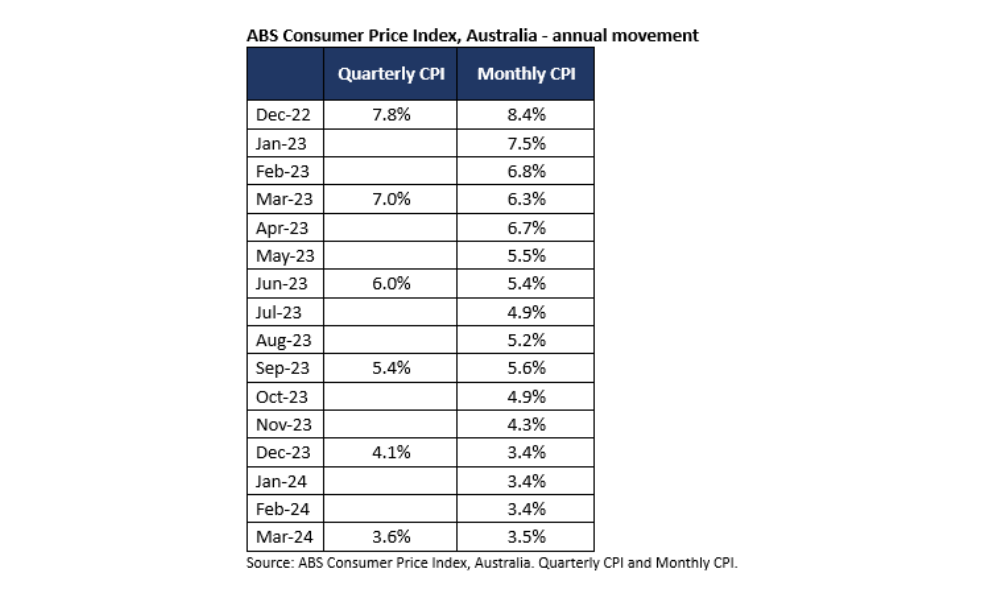

Latest ABS information confirmed a slight enhance in annual inflation to three.5% in March, after a interval of stability. This uptick means that inflation pressures, whereas decrease than the earlier 12 months’s peak, stay persistent.

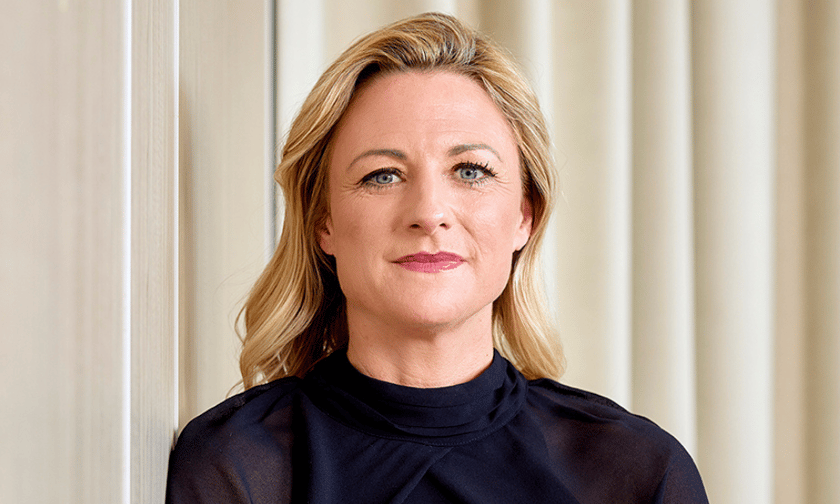

“These CPI figures are a well timed reminder to not financial institution on a price lower earlier than it hits your checking account,” mentioned Sally Tindall (pictured above), RateCity.com.au’s analysis director.

Monetary technique for householders

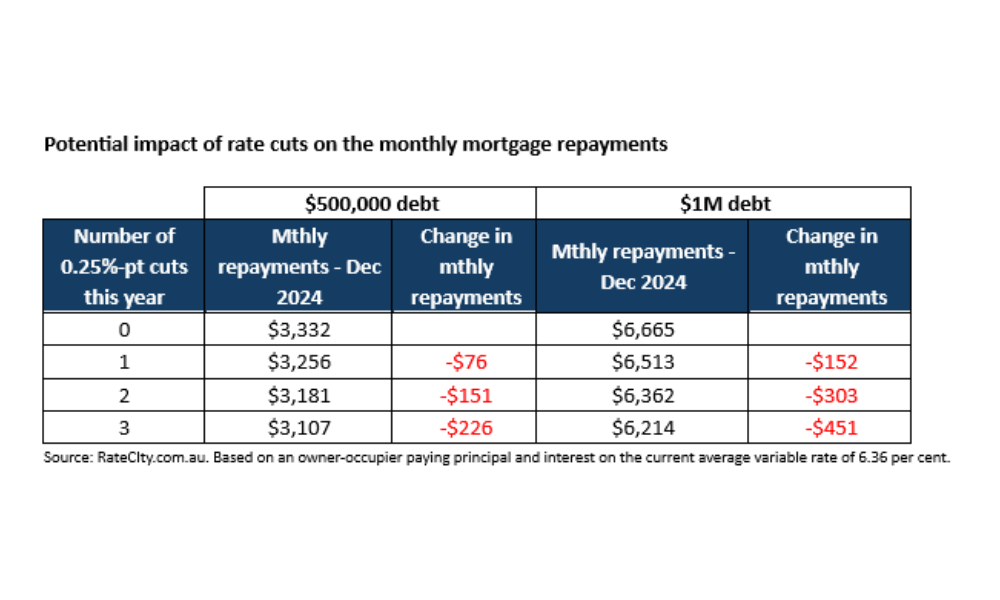

The uncertainty across the timing and extent of price cuts can considerably influence householders, particularly these with appreciable mortgage money owed. With predictions various from no price cuts to a few in 2024, the monetary implications for debtors are substantial.

“Debtors banking on a handful of RBA price cuts this 12 months ought to shift their focus to creating positive they will meet their present mortgage repayments for the rest of 2024,” Tindall mentioned.

Recommendation for debtors amid uncertainty

In gentle of ongoing inflation and price lower uncertainties, Tindall suggested debtors to actively have interaction with their banks to safe higher charges.

“If you would like a price lower, perceive that proper now, the ball is in your court docket, not the RBA’s,” she mentioned. “The banks are nonetheless within the temper to barter, and also you may discover you nab your individual private price lower earlier than the month’s out.”

Get the most well liked and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE day by day publication.

Sustain with the most recent information and occasions

Be part of our mailing checklist, it’s free!